“I’m feeling nervous.” I’ve heard this phrase a few times over the last few months. The most recent was in a London meetup, as one director sipped her drink. “There’s been a lot of layoffs recently, hasn’t there?” she commented, with a slight shuffle of her feet. One person to her left politely nodded, though they shifted slightly as well.

I don’t blame them. The business jitters radiated across the metaverse and spatial computing companies, as investments dried up for most companies, and lines of work turned cold. Investment appetite flipped in 2023 towards generative AI, as VCs read the tea leaves and diverted funds. The most recent was when Snap shuttered a unit dedicated to business AR, a month after Disney’s metaverse lead departed the magic mouse’s firm.

That period of quiet has led to nervous murmurs. “Where is the activity?” remarks pundits on Forbes. “Where are the users, or the hardware devices?” That sentiment carries over to Google Trends, where people have been searching for the term less. Dom Tait from Omdia calls it the doldrums, with many that are “disenamored by the gulf between promise and actuality.” I agree with the sentiment; it feels like we are in a cold snap, as companies plod through the ice fields cold and somewhat alone.

But I think there are some nuances to this. Does a quiet period mean we have no activity? Not at all; we are seeing a whole lot of activities happening in the background as people work on their secret projects. They’re not loud, yes, but they exist. But what’s unclear is its longer viability in the area.

I’ve dug a little deeper, tapping the shoulders of experts within (and outside) the industry to try and paint a vivid picture of what is actually going on. And what do we see? Well, the picture is a little cold; but there is a hopeful sunset on its horizon.

Executive summary

Short-term thinking: I am reasonably confident that the Vision Pro will cause a flurry of new investments and interest in the area, making today’s interest seem myopic.

Asian growth: Our Western lens obscures high growth in other parts of the world.

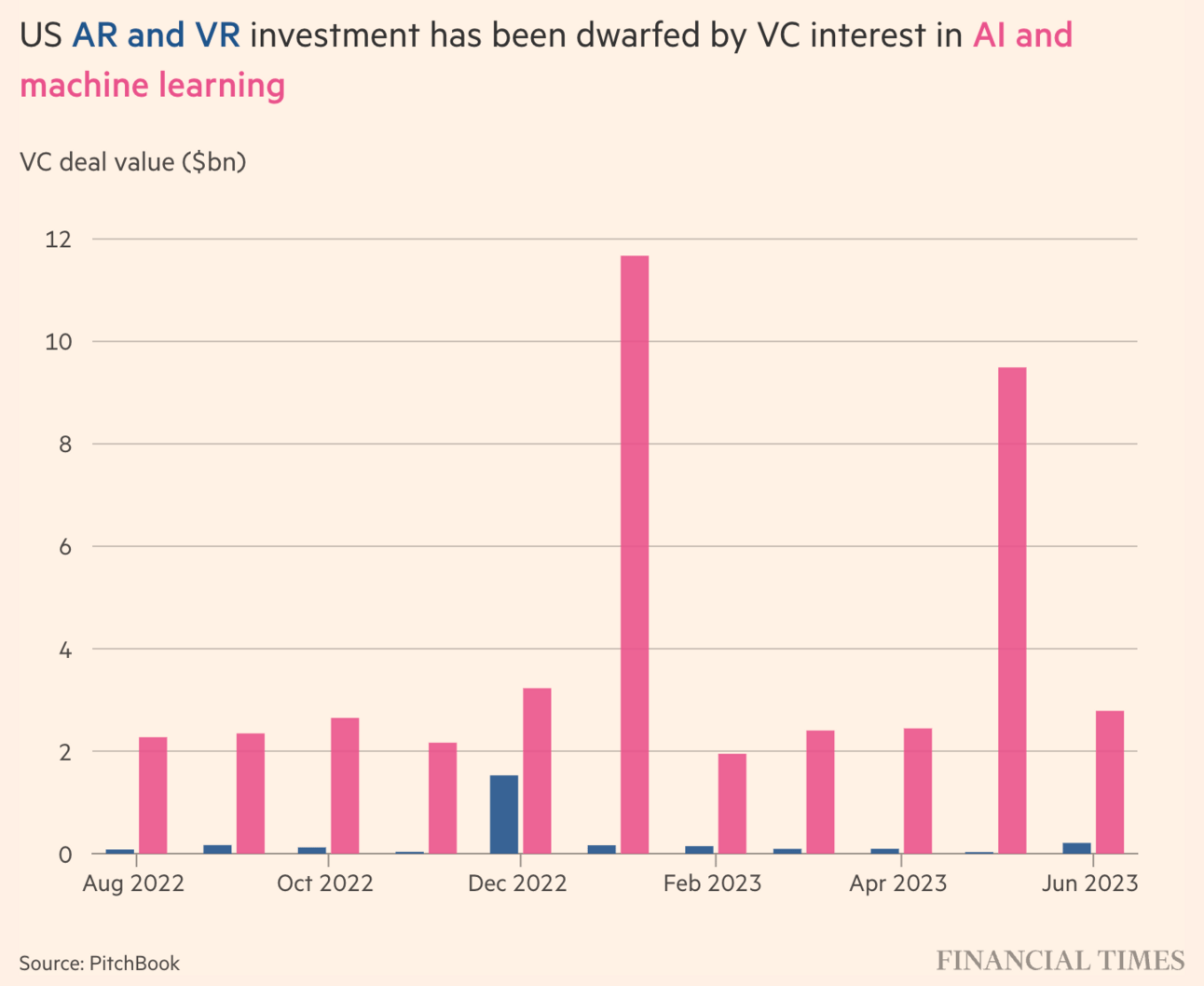

AI over metaverse: There is a stark jump in people interested in AI over the metaverse, proven through Google searches and VC appetite.

What metaverse? Many companies prefer to stay away from the M word.

We seem to be in a slightly messy time. Credit: Midjourney.

A change in investment

Is the metaverse itself a weaker market today? Companies are still building products and services, even if the attention itself has shifted with time. VC investments in 2021 manifested some results in 2022, with even more cropping out of the woodwork in 2023. Yes, AI investments are outstripping the likes of AR and VR; recent data from Pitchbook (and featured in the FT) attest to the gap. But millions still flow into the comparatively nascent area each month.

We have also seen some interesting investments which are smaller but are not necessarily representative of the market health. GEEIQ raised $8.2m in funding recently to offer insights for metaverse platforms — at a time when analytics is very important. Small compared to the likes of Improbable several years ago, but still shows a market in continued maturity.

So is it a case where we are treating spatial computing too harshly? That’s what Adam Samson at FutureDeluxe implies, saying that we are in the process of maturing. But I am unsure of its validity. Accenture and PwC have been working with immersive technologies for many years, and I am sure Jaron Lanier would raise an eyebrow if he heard that immersive technologies were a recent thing. What’s more likely is that the actual focus has changed, rather than its actual maturity.

But even then, I look at what’s happening in Asia and take a step back.

The growth of Asia

In July 2022, the Spanish Government announced that it would invest €3.8m into companies working on metaverse and web3 technologies. In the same month, Shanghai allocated $1.5bn into its Metaverse Development Fund – over 365 times more than Spain.

It’s a stark investment difference, a hill of Euros compared to a mountain of Yuan. Cities within China have consistently out-invested other countries; Shanghai, Nanjing, Hangzhou, Zhengzhou and others have unveiled metaverse strategies, with the former focusing on tourism. Not all countries trail behind; South Korea invested $51m into metaverse projects in March 2023. Still, the gulf remains wide.

That investment gap will likely mean China has a head start in immersive technologies for many years to come. The strategies laid out by its cities eye billions in revenue by 2025 or 2030, while other countries unveil comparatively meagre budgets. China is likely to be well-positioned to regain its lead in metaverse-related technologies, which may gain prominence this decade.

One more example. China Mobile is actively contributing to metaverse advancements – with huge clout too as it has over 940m members. The telecom company formed a large industry alliance with HTC, Huawei and Xiaomi among many others, to form “the world’s strongest metaverse circle of friends.” Two months later, China Mobile also announced a 5G “super network” designed to help with the requirements of metaverse-related applications.

We tend to have a Western lens. But it’s clear that other countries are putting heaps of research and data into the area, hoping for sprouts of growth to bloom. But even with this activity, the actual label we use is up for debate. So let’s hop into that.

China is investing a lot in the metaverse and spatial computing. Credit: Midjourney.

A shift in conversation

First, I should show my hand a little here: I think tech literacy on the metaverse is abysmal, and part of this is our own fault. We’ve cluttered the scene with so many words and by-words with a muddle of definitions, none of which are clear or concise. One expert approached me with the idea of an MR metaverse, which is like mixing two types of cola together to see if it improves the taste. It doesn’t, and it further clutters the external positioning of the term.